geothermal tax credit new york

Form IT-6-SNY Metropolitan Commuter Transportation Mobility Tax MCTMT for START-UP NY. In comparison a standard heat pump installation costs 3800 to 8200 on average and has higher operating costs.

Geothermal Incentives By State Ny Ma Ct Md Nj Pa

The credit is equal to 25 of your qualified solar energy system equipment expenditures and is limited to 5000.

. It also authorized and directed increased funding for research by the Department of Energy and enabled the Bureau of Land Management to address its backlog of geothermal leases and permits. Learn more about the regulations of the credit and how. The electricity must be used in the home.

The solar energy system equipment credit is not refundable. Politics1 calls itself the the most comprehensive online guide to American politics and pretty much lives up to its name-- WABC TV-7. A non-profit organization working for rural communities and healthy working forests across northern New Hampshire Maine Vermont and New York has financial incentives available to help several commercial buildings in Coos Grafton or Carroll Counties switch to high-efficiency wood pellet heat.

Your complete directory of New York candidates for Governor United State Senator and Congress in the current election cycle. IT-221 Disability Income Exclusion. After that the percentage steps down and then stops at the end of 2023.

Renewable Energy Property Tax. RPD-41375 NOL Carryforward Worksheet for Fiduciary Income Tax. To claim a foreign tax credit you may need to file Form 1116 along with Schedule 3 and your 1040 tax return.

Section 48F Clean Electricity Investment Tax Credit. If you credit is greater than your tax liability it will not generate a tax refund. State political parties.

The system must also be installed and used at your principal residence in New York State. The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. Form IT-237 Claim for Historic Homeownership Rehabilitation Credit.

New Yorks own communities are leaders on fighting climate change from policies at the local to the state level and to key partnerships and incentives through the. New credit A technology-neutral ITC under new section 48F would be available for the qualified investment in an electric generating facility or any energy storage property beginning construction after December 31 2026 and for which the greenhouse gas emissions rate is not greater than zero. Please visit the Database of State Incentives for Renewables Efficiency website DSIRE for the latest state and federal incentives and rebates.

If youre using. The full credit is available through the end of 2019. It can only reduce or eliminate your liability how much money you owe to the IRS.

IT-203-F Multi-Year Allocation Form. If you paid tax to a foreign country or US. Equipment that qualifies for the Residential Renewable Energy Tax Credit includes solar wind geothermal and fuel-cell technology.

Solar wind geothermal and fuel cell technology are all eligible for the residential energy efficient property credit. Form IT-203-F Multi-Year Allocation Form. Tax on the same income you may be able to take the foreign tax credit to reduce your domestic tax liability.

Form 5695 calculates tax credits for a variety of qualified residential energy improvements including geothermal heat pumps solar panels solar water heating small wind turbines and fuel cells. The heat pumps must meet the requirements of the ENERGY STAR program. IT-1121 NYS Resident Credit Against Separate Tax on Lump.

And state news sources. The credit has been extended many times and as of December 2021 if you make energy-efficient home improvements before Jan. Existing homes and new construction both qualify for this tax credit on purchases of.

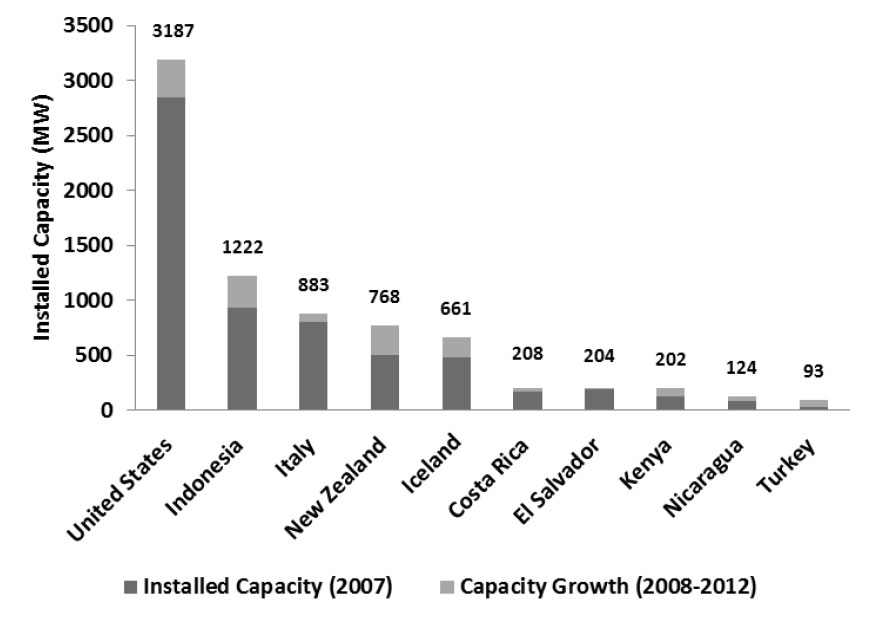

Well use 25000 gross cost of a solar energy system as an example. Last month Senate Republicans introduced a bill that would lower the personal and corporate income tax rates to 39 from 425 and 6 and create a 500-per-child tax credit. An average geothermal heat pump costs between 1500 to 2500 per ton within Dandelions service territory which includes parts of New York State.

Sign Up for Email Updates. Solar fuel cells 150005 kW and small wind 100 kW are eligible for credit of 30 of the cost of development with no maximum credit limit. The Biden administration on Wednesday announced a record-breaking offshore wind lease sale off of the coasts of New York and New Jersey a lease projected to generate clean energy power 2.

The end result of claiming a state tax credit is that the amount of the state tax credit is effectively taxed at the federal tax level. Residential Energy-Efficient Property Credit. This investment tax credit varies depending on the type of renewable energy project.

Tax Credits Rebates. The incentive is 25 of. The official state election office.

Qualifying equipment includes solar-powered units that generate electricity. Installing alternative energy equipment in your home such as solar panels and geothermal heat pumps can qualify you for a credit equal to 30 of your total cost. SW Washington DC 20585 202-586-5000.

IT-237 Claim for Historic Homeownership Rehabilitation Credit. This Act made new geothermal plants eligible for the full federal production tax credit previously available only to wind power projects and certain kinds of biomass. The geothermal energy tax credit allows homeowners to claim 22 to 26 of the total cost from their federal taxes throughout 2023.

Facebook Twitter Youtube Instagram Linkedin. Possession and are subject to US. IT-6-SNY Metropolitan Commuter Transportation Mobility Tax for START-UP NY.

The Non-Business Energy Property Tax Credit helps qualified homeowners get a tax break when they purchase and install a new energy efficient HVAC system. Form IT-252 Investment Tax Credit for the Financial. While there are minimum qualifications most new HVAC systems do qualify for the full 3000 tax credit.

For example the net percentage reduction for a homeowner in New York who claims both the 25 state tax credit and the 26 federal tax credit for an 18000 system is calculated as follows assuming a federal income tax rate of 22. This is the total gross. The ITC is generated at the time the.

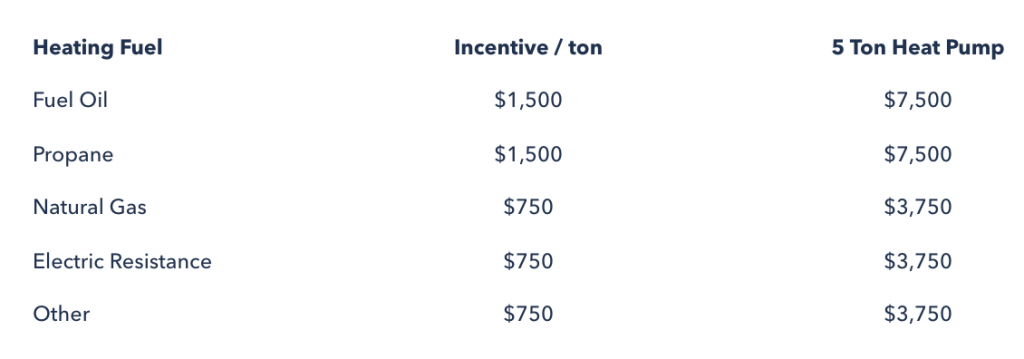

If your tax bill is 300 but your non-refundable tax credit is 1000 you will only use 300 of your credit and will have. Geothermal HVAC reduces utility bills and uses 25 to 65 less energy and electricity than conventional systems. While the precise heat pump size is dictated by the homes heating and cooling needs a standard single-family 2000 square foot home usually requires a 5 ton heat pump 7500 to 12500.

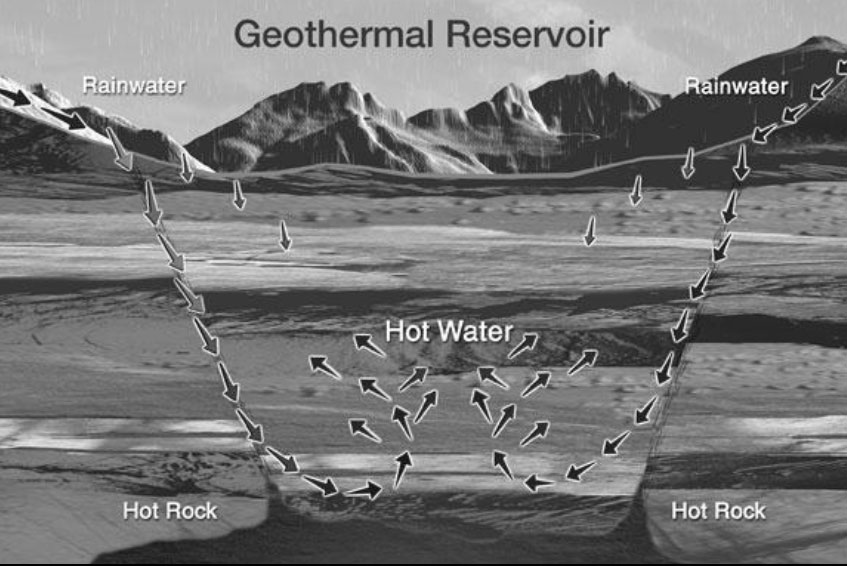

1 2024 you are eligible to reduce the amount of taxes you owe. Solar panels or photovoltaics for generating electricity. Geothermal heat pumpsthese source the earths natural heat from the ground in order to provide heating air condition and hot water.

There is a 10 credit for geothermal microturbines 2 MW and combined heat and power plants 50 MW. Schedule PTE Pass-Through Entity Tax. How much is the credit.

NYSERDAs CES White Paper found that without displacing a substantial portion of the fossil fuel-fired generation that New York City currently relies upon the statewide 70 by 30 Target would. However any credit amount in excess of the tax due can be carried over for up to. The water heated by the system must be used inside the home and at least half of the homes water.

First you will need to know the qualified solar electric property costs. The new Tier 4 will increase the penetration of renewable energy into New York City NYISO Zone J which is particularly dependent on polluting fossil fuel-fired generation. The Geothermal Tax Credit however is a non-refundable personal tax credit.

New Mexico has a state income tax that ranges between 17 and 49 which is administered by the New Mexico Taxation and Revenue DepartmentTaxFormFinder provides printable PDF copies of 81 current New Mexico income tax forms.

Geothermal Incentives By State Ny Ma Ct Md Nj Pa

Blog Climatemaster Geothermal Hvac

What Incentives Rebates Are Available For Geothermal In Connecticut Dandelion Energy

Geothermal Tax Credits Incentives

Proptech Startups Pave And Drill The Way Geothermal Power Advances As Sustainable Energy Source Cooperatornews New York The Co Op Condo Monthly

Drilling Costs At Top Of Economic Factors For Geothermal Projects Drilling Contractor

Geothermal Tax Credits Incentives

Drilling Costs At Top Of Economic Factors For Geothermal Projects Drilling Contractor